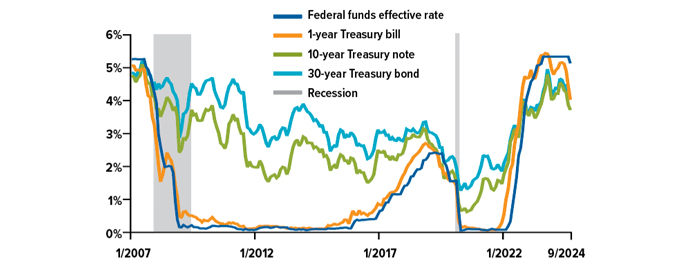

Treasury Yields Off 17-Year Highs

As the Federal Reserve raised interest rates to combat inflation, yields on U.S. Treasury securities climbed to levels not seen since before the Great Recession (see chart). Now that the Fed has begun lowering rates, yields have dropped, but they remain at relatively high levels. Considering how stubborn inflation has been, the Fed might move gradually in decreasing rates, but as they do, you can generally expect Treasury yields to decline. In the longer term, Treasuries purchased in the current higher-rate environment could offer higher yields than new issues, potentially increasing their value on the secondary market.

You might consider holding Treasuries to maturity to add stability and predictable income to your portfolio, or you could purchase them with an eye toward selling if prices rise — or both. Whatever your goals, there are a variety of Treasury securities available, with maturity dates ranging from four weeks to 30 years. Although longer-term securities typically offer higher yields, the opposite has been true during the last two years, in part because short-term Treasuries respond more directly to changes in the federal funds rate, the Fed’s primary tool for influencing interest rates. As the funds rate declines, Treasury yields by maturity — called the yield curve — might return to a more typical pattern.

Purchasing Treasuries

Treasuries are sold in $100 denominations and can be purchased as new-issue securities through a Treasury auction, either directly from the U.S. Treasury (treasurydirect.gov) or from a bank, broker, or dealer, or on the secondary market through a brokerage firm.

When buying Treasuries (or any bonds), keep in mind that yield is the annual return based on the purchase price and the interest rate paid on the face (par) value, called the coupon rate. When a bond is purchased at face value, the yield is the same as the coupon rate. Treasuries, whether at auction or on the secondary market, are typically sold above or below face value — at a premium or a discount, respectively — to offer a yield in line with the current market. Interest paid on Treasuries is subject to federal income tax but exempt from state and local income taxes.

Treasury bills (T-bills) are short-term securities issued with maturities of four, eight, 13, 17, 26, and 52 weeks. T-bills are sold at a discount from their face value, and the difference between the discount price and the face value at maturity, called the discount rate, is interest paid on the bill.

Treasury notes (T-notes) earn a fixed rate of interest every six months and are issued in maturities of two, three, five, seven, and 10 years. The 10-year Treasury note is often referenced regarding the performance of the bond market and is also used as a benchmark by the mortgage market.

Treasury bonds (T-bonds) are similar to T-notes but have a maturity of 20 or 30 years. Like the T-note, they provide an interest payment every six months.

Following the Fed

Yields on short-term Treasuries, up to the one-year bill, generally follow the federal funds rate. Until the rapid increase in the funds rate that began in 2022, longer-term Treasuries offered higher yields, because investors typically demand a higher premium for tying up their cash for a longer period. Now that the funds rate has begun to decline, Treasury yields may move toward this more typical pattern.

Source: Federal Reserve, 2024

Treasury inflation-protected securities (TIPS) are inflation-indexed bonds with the principal adjusted by changes in the Consumer Price Index (CPI). If the CPI rises, the principal value of TIPS increases, which can be a helpful hedge against inflation. TIPS are issued in maturities of five, 10, and 30 years. (Unless you own TIPS in a tax-deferred account, you must pay federal income tax on the income plus any increase in principal, even though you won’t receive any accrued principal until the bond matures.)

Treasury floating-rate notes (FRNs) are issued with a two-year maturity and an interest rate that is adjusted weekly, based on the most recent discount rate for 13-week T-bills. However, interest payments are made quarterly.

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities fluctuates with market conditions. If not held to maturity, they could be worth more or less than the original amount paid.